Tabell’s Market Letter – June 02, 1947

View Text Version (OCR)

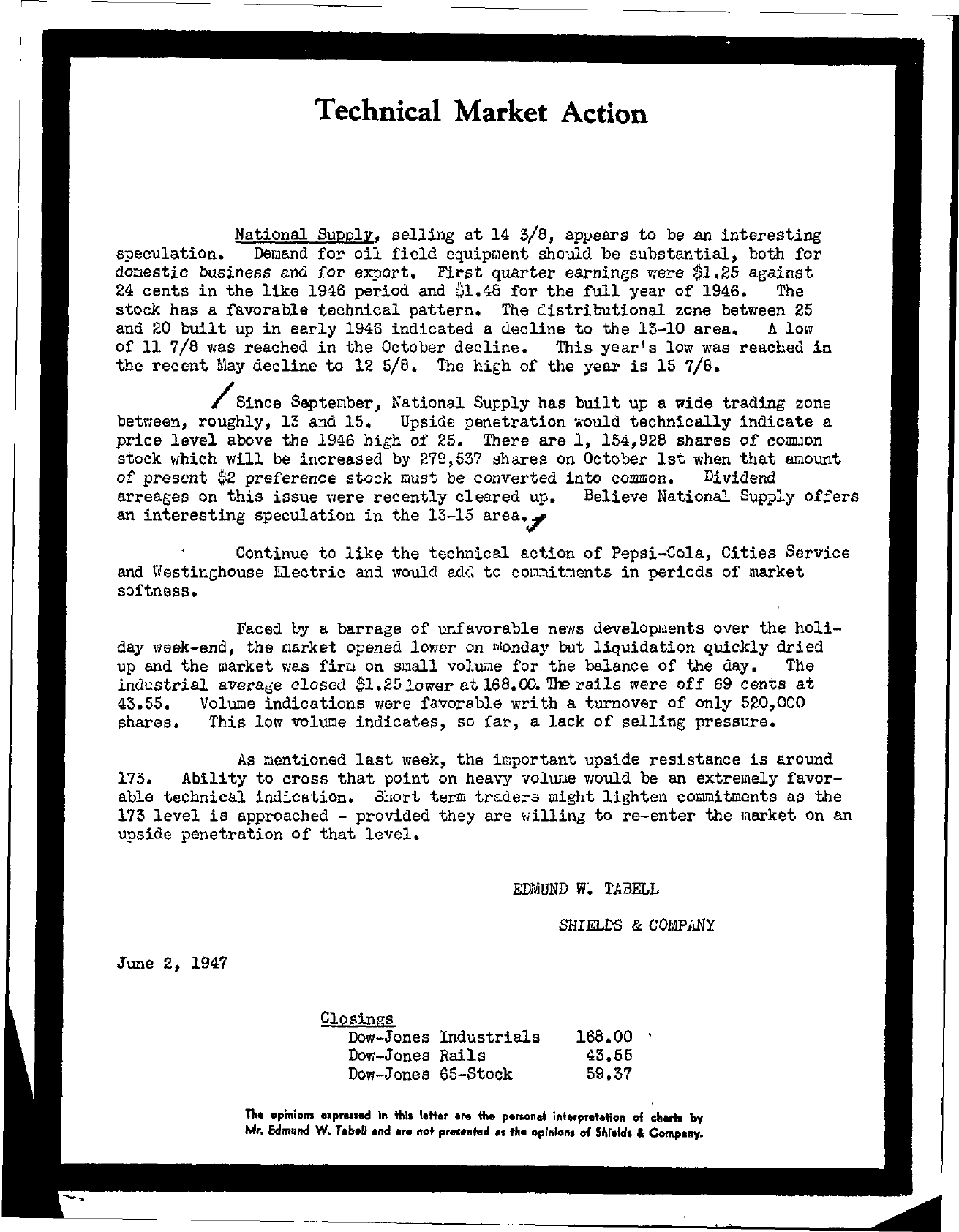

Technical Market Action National Supply, selling at 14 5/8, appears to be an interesting speculation. DeQand for oil field equiptlent should be substantial, both for dooestic business and for export. First quarter earnings were 1.25 against 24 cents in the like 1946 period and 1.48 for the full year of 1946. The stock has a favorable technical pattern. The distributional zone between 25 and 20 built up in early 1946 indicated a decline to the 15-10 area. A low of 11 7/8 Vias reached in the October decline. This year 1 s low was reached in the recent 1l1ay decline to 12 5/8. The hibh of the year is 15 7/8. Since Septeober, National Supply has built up a wide trading zone between, roughly, 15 and 15. Upside penetration Vlould technically indicate a price level above the 1946 high of 25. There are 1, 154,928 shares of comuon stock Ilhich wlll be increased by 279,557 shares on October 1st when that ru;ount of prescnt 2 preference stock ust be converted into common. Dividend arreages on this issue Vlere recently cleared up. Believe National Supply offers an interesting speculation in the 15-15 area. Continue to like the technical action of Pepsi-Cola, Cities Service and WestinGhouse EJ.ectric and would adG to cOld.ditr.1(mts in periods of market softness. Faced by a barrage of unfavorable news developluents over the holiday week-end, the 1arket opened lowcr on 1donday but liquidation quickly dried up and the market Vias firw on soall vollhde for the balance of the day. The industrial avera.;e closed 1.25 lower at 168.00. TIe rails were off 69 cents at 45.55. Volume indications were favorable writh a turnover of only 520,000 shares. This low voluoe indicates, so far, a lack of selling pressure. As tlentioned last Iveek, the important upside resistance is around 175. Ability to cross that point on heavy volurJe would be an extremely favorable technical indication. Short term traders might lighten CO;lllitments as the 175 level is approached – provided they are ;;illin,. to re-enter the laarket on an upside penetration of that level. J\Ule 2, 1947 EDMUND W TABELL SHIELDS & COMPANY Closings Dow-Jones Industrials Dow-Jones Rails DoV/-Jones 65-Stock 168.00 45.55 59.57 Th. opinions eapres.ed in this letter . the penonaA int.rpretation of ch.rta by Mr. Edmund W. r.b.n .nd .,.. not presented tIr. opinion. of Shr.ld. & Company.